closed end funds leverage risk

NEW YORK--BUSINESS WIRE--The DWS closed-end funds listed below announced today their regular monthly distributionsDetails are as follows. While technically the coverage.

Understanding Leverage In Closed End Funds Nuveen

At the time roughly 72 of closed-end funds used leverage compared to 64 at the end of 2017 which investors feared would challenge the funds to roll over the debt and result in more expensive financing hurting returns.

. The funds use of leverage may cause higher volatility for the funds per share NAV market price and distributions. Closed-end funds frequently trade at a discount to their net asset value NAV. Declaration 04072022 Ex.

5 Closed-End Funds Worth Buying On Sale. Just like open-ended funds closed-end funds are subject to market movements and volatility. Preferred stocks of closed end funds CEFs tend to be some of the safest preferred stock in existence.

NAV returns are net of fund expenses and assume reinvestment of distributions. Risk considerations Closed-end funds unlike open-end funds are not continuously offered. A closed-end fund manager does not have to hold excess cash to meet redemptions.

The following information applies to closed-end funds in general. PremiumDiscount to NAV represents the percentage by which the funds market price exceeds or is less than net asset value NAV. Many closed-end funds have income distributions of 8 or more.

Leverage is the secret sauce that allows many closed-end funds to pay much higher dividends than similar conventional mutual funds or ETFs. Shares of closed-end funds frequently trade at a. The use of leverage allows the CEF to maintain a higher distribution yield than open-end mutual funds.

If you cannot stomach large swings in the value of your. Leverage typically magnifies the total return of the funds portfolio whether that return is positive or negative. The Global Total Return and Global Dynamic Income Funds may invest up to 100 of their assets in foreign securities and invest in an array of security types and market-cap sizes each of which has a unique risk profile.

Shares of closed-end funds are subject to investment risks including the possible loss of principal invested. Closed-end funds with managed distribution programs seek to pay a consistent dividend each month or quarter. Because there is no need to raise cash quickly to meet unexpected redemptions the capital is considered to be more stable than in open-end funds.

More leverage equals more risk and price volatility. Closed-end funds frequently trade at a discount to their net asset value. The value of a CEF can decrease due to movements in the overall.

Leverage typically magnifies the total return of the funds portfolio whether that return is positive or negative. The funds use of leverage may cause higher volatility for the funds per share NAV market price and distributions. Using those numbers youre making 4 annually on the borrowed funds.

This is because of the requirements that the CEF have at least 200 asset coverage for preferred stock and 300 for debt asset coverage of senior securities which means debt and preferred stocks. Investment policies management fees and other matters of interest to prospective investors may be found in each closed-end fund annual and semi-annual report. For additional information please contact your investment professional.

There is a one time public offering and once issued shares of closed-end funds are sold in the open market through a stock exchange. Closed-end funds may be leveraged and carry various risks depending upon the underlying assets owned by a fund. Closed end funds are subject to management fees and other expenses.

Closed-end funds may be leveraged and carry various risks depending upon the underlying assets owned by a fund. A lot of people google terms like best CEFs to buy in 2021 or top high-yielding closed-end funds and other phrases like that. Closed-end funds frequently trade at a discount to their net asset value NAV.

Unlike with open-end mutual funds a closed-end fund manager does not face reinvestment risk from daily share issuance. Primarily invest in tax-exempt municipal bonds and may utilize leverage to enhance income potential. Investors should contact a funds sponsor for fund-specific risk information and.

BlackRock offerings include national and state specific funds. Kiplinger and other publications often cater to this demand by producing lists. Fund shares are not guaranteed or endorsed by any bank or other insured depository institution and are not federally insured by the Federal Deposit Insurance Corporation.

For additional information please contact your investment professional. Shares of closed-end funds frequently trade at a discount to net asset value. Shares of closed-end funds frequently trade at a market price that is below their net asset value.

Some closed-end funds have a managed distribution strategy. Leverage works great as long as the spread between short- and long-term rates doesnt shrink too much. Investment policies management fees and other matters of interest to prospective investors may be found in each closed-end fund annual and semi-annual report.

What Are Mutual Funds 365 Financial Analyst

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Investing In Closed End Funds Nuveen

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Understanding Leverage In Closed End Funds Nuveen

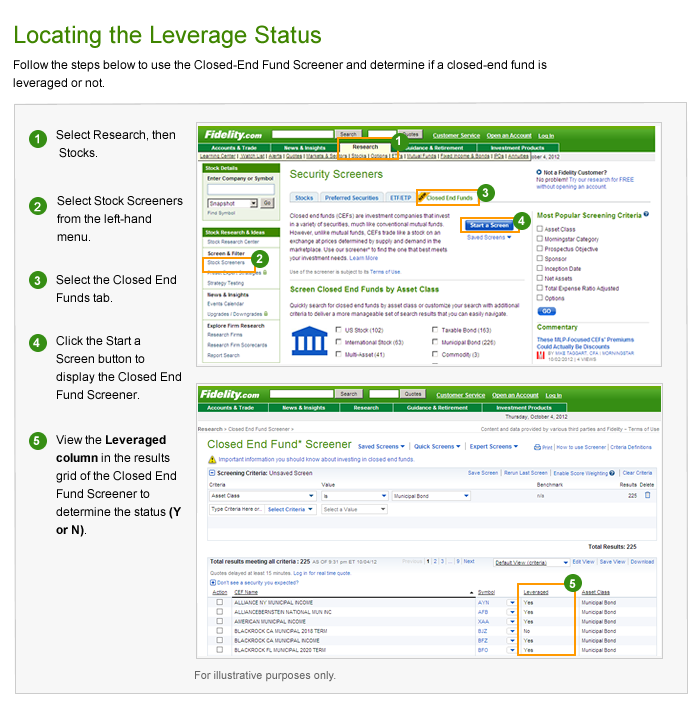

Closed End Fund Leverage Fidelity

What Is The Difference Between Closed And Open Ended Funds Quora

Understanding Leverage In Closed End Funds Nuveen

What Is The Difference Between Closed And Open Ended Funds Quora

5 Reasons To Use Closed End Funds In Your Portfolio Blackrock

5 Best High Yielding Closed End Funds To Buy

Understanding Leverage In Closed End Funds Nuveen

5 Best High Yielding Closed End Funds To Buy

Guide To Closed End Funds Money For The Rest Of Us

What Is The Difference Between Closed And Open Ended Funds Quora

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Understanding Leverage In Closed End Funds Nuveen